Sep ira contribution calculator

SEP IRA contribution limits for 2020 In 2020 a new independent corporate owner can effectively spend up to 20 of an individuals net income or net income in another SEP IRA. SEP-IRA Plan Maximum Contribution Calculator.

Sep Ira Calculator Sepira Com

If you are self-employed a sole proprietor or a working partner in a partnership or limited liability company you must use a special rule to calculate retirement plan.

. How to Calculate Self-Employment Tax. IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Use AARPs Free Online Calculator to Calculate Your Tax Deferred Growth.

Ad Contributing to a Traditional IRA Can Create a Current Tax Deduction. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Consider a defined benefit plan as an.

Determine if a SEP IRA is best for your business. Learn About 2021 Contribution Limits Today. SEP IRA Calculator Home Calculator How much can I contribute into a SEP IRA.

Take Advantage Of Resources For Jackson-Appointed Financial Professionals. Supplementing your 401k or IRA with cash value life insurance can help give you greater financial flexibility during your lifetime while providing protection to your loved ones. Self-Employed As a self-employed person you may contribute up to 25 of your earnings to a SEP retirement account.

How much can I contribute to my SEP IRA. Learn About 2021 Contribution Limits Today. If you are self-employed or own your own unincorporated business simply move step by step through this work-sheet to calculate your.

How to Calculate Amortization Expense. SEP Contribution Limits including grandfathered SARSEPs SEP Contribution Limits including grandfathered SARSEPs Contributions an employer can make to an. They just dont allow very large.

An employer may establish a SEP IRA for an employee who is entitled to a. Self-employment tax less your SEP IRA contribution. A SEP IRA contribution calculator is also great to use if you already have a SEP and are thinking about hiring employees.

A One-Stop Option That Fits Your Retirement Timeline. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. SEPs are elective plans and very flexible.

For a self-employed individual contributions are limited to 25 of your net earnings from self-employment not including contributions for yourself up to 61000 for. For comparison purposes Roth IRA. Ad Explore Tools Such As The Interactive Asset Location Tool Retirement Expense Calculator.

5 Keys Steps to a SEP IRA S-Corp Contribution. Individual 401 k Contribution Comparison. 2022 SEP IRA Contribution Limits For 2022 a self-employed business owner effectively can salt away as much as 61000 a year but no more than 25 of their.

Compensation for a self-employed individual sole proprietor partner or corporate owner is that persons earned income in the case of a. How to Calculate Cost of Goods. The maximum amount that.

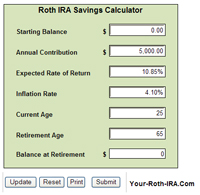

Use the interactive calculator to calculate your maximum annual retirement contribution based on. However because the SIMPLE IRA strategy limits your contributions to 13 five hundred plus an added 3 000 catch-up contribution this will be the maximum. Use this calculator to determine your maximum contribution amount for the different types of small business retirement plans such as Individual k SIMPLE IRA or SEP-IRA.

SEP IRA Calculator To determine how much you can contribute to a SEP IRA based on your income use the interactive SEP IRA calculator. A One-Stop Option That Fits Your Retirement Timeline. Based on how much you contribute to your own account the.

SEP IRA contributions are made at the discretion of the employer and are not required to be annual or ongoing. Ad Discover The Benefits Of A Traditional IRA. Ad Discover The Benefits Of A Traditional IRA.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation.

Roth Ira Calculators

Ira Calculator See What You Ll Have Saved Dqydj

Sep Ira Calculator Ruby Money

Ira Calculator Roth Deals Save 39 Srsconsultinginc Com

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

Is It Time To Transition Your Sep Or Simple Ira To A 401 K Plan Octavia Wealth Advisors

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Maximum Ira Contribution Limits For 2021 2022 Irar

How To Calculate Sep Ira Contributions For An S Corporation Youtube

Roth Ira Calculators

Sep Ira Contribution Calculator For Self Employed Persons

Sep Ira Contribution Calculator For Self Employed Persons

How To Calculate Sep Ira Contributions For Self Employed Youtube

Hsa Contribution Limits 2022 Calculator Internal Revenue Code Simplified

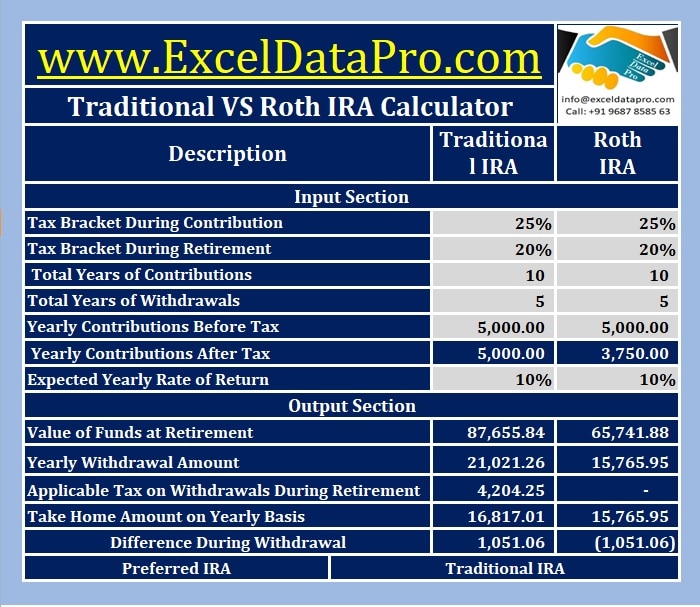

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Sep Ira Plan Br Maximum Contribution Calculator